In the fast-paced world of cryptocurrency, where fortunes are made and lost in the blink of an eye, I consider myself lucky to have dodged a bullet with HODLnaut. As a middle-aged guy navigating the complexities of digital finance, my journey with HODLnaut was a rollercoaster that left me questioning the accountability of its founders.

A JOURNEY INTO CRYPTO: HODLNAUT AND ME

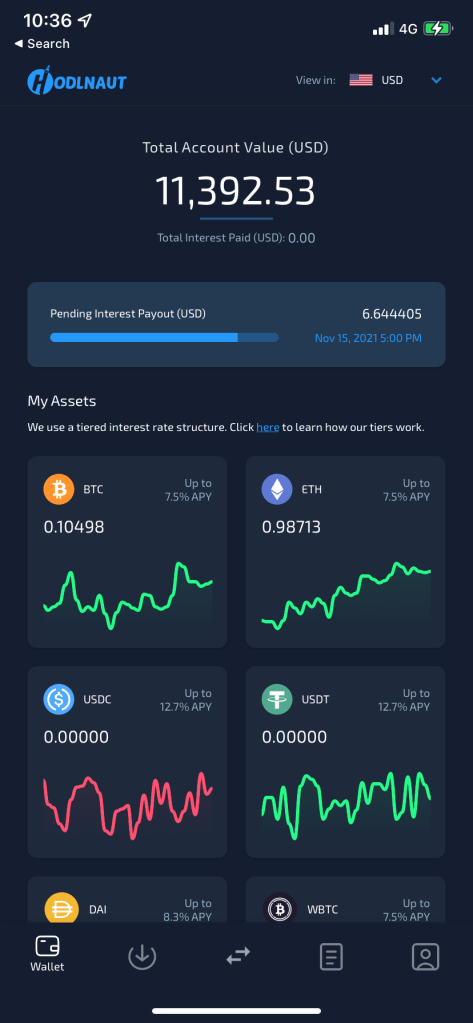

In 2021, armed with a curiosity for crypto and a modest $11,000 investment, I took the plunge into the world of HODLnaut. The promise of earning interest on my cryptocurrency holdings seemed like a win-win. Little did I know, the storm that was brewing behind the scenes would soon put my investment at risk.

THE RISE AND FALL OF HODLNAUT

HODLnaut, a Singapore-based lending and borrowing platform, had its roots in noble intentions. Co-founded by Juntao Zhu and Simon Lee in 2019, it aimed to provide a safe space for users to earn interest on their cryptocurrencies. However, the fairy tale took a dark turn when HODLnaut found itself entangled in the collapse of TerraUSD, a stablecoin that lost its peg with the US Dollar.

TROUBLE IN PARADISE: ABRUPT WITHDRAWAL HALTS

In August 2022, I, along with other users, was blindsided by HODLnaut’s decision to disable withdrawal functionality. Citing ‘market conditions,’ the platform left us in the dark about the true extent of its troubles. Unbeknownst to us, HODLnaut had been holding a significant portion of our funds in TerraUSD, which had plummeted in value. This move, coupled with the failure to disclose their involvement with TerraUSD, marked the beginning of a tumultuous period for HODLnaut and its users.

THE SILENT STRUGGLE: SPF DEMANDS AND EMPLOYEE CULLING

As HODLnaut users grappled with the inability to withdraw their funds, behind the scenes, the Singapore Police Force (SPF) demanded that HODLnaut transfer the remaining assets. This crucial development, concealed from users, showcased the severity of the situation. To add insult to injury, HODLnaut discreetly culled 80% of its workforce, revealing the extent of its silent struggle.

THE UNVEILING: HODLNAUT’S INSOLVENCY

By August 2022, HODLnaut officially disclosed its involvement with the Terra blockchain. However, it attributed its insolvency not only to this but also to the overall decrease in cryptocurrency prices and substantial user withdrawals. In a shocking revelation, HODLnaut admitted to converting a staggering $317 million of user deposits into TerraUSD, resulting in massive losses when the stablecoin collapsed.

JUDICIAL MANAGEMENT: A GLIMMER OF HOPE?

In a bid to salvage what was left, HODLnaut applied for judicial management. The Singapore High Court granted this, appointing Angela Ee and Aaron Loh of EY Corporate Advisors Pte. as interim judicial managers. This move was seen as a lifeline, offering a chance for restructuring and potential recovery.

THE BETRAYAL: FAILED RESTRUCTURING AND LIQUIDATION ORDER

Hope for a resolution was shattered when HODLnaut’s proposed restructuring plan, which included the continuation of existing directors, was rejected by key creditors in January 2023. The preference was for liquidation, a decision that left 17,000 customers, in limbo. The Singapore High Court, in November, ordered HODLnaut to undergo liquidation.

ACCOUNTABILITY: WHERE ARE THE FOUNDERS?

As someone who narrowly escaped the clutches of HODLnaut’s downfall by withdrawing my capital in time, I find myself questioning the accountability of its founders. Juntao Zhu and Simon Lee, who once promised a secure platform, led us into a financial abyss. The founders’ decision to convert user deposits into a volatile stablecoin without disclosure raises serious ethical questions. Where is their responsibility to the thousands of users left in financial distress?

CONCLUSION: LESSONS LEARNED AND MOVING FORWARD

My journey with HODLnaut, though harrowing, has taught me valuable lessons about the unpredictable nature of the crypto world. As the founders face the consequences of their actions and the platform undergoes liquidation, I am left pondering the broader implications for the crypto industry. It’s a stark reminder that, in this volatile space, trust is a precious commodity, and accountability should never be sacrificed for the allure of quick gains.

In the aftermath of HODLnaut’s collapse, I, like many others, am left to pick up the pieces of a shattered investment. The crypto landscape is evolving, and as investors, we must tread cautiously, demanding transparency and accountability from the platforms we entrust with our hard-earned money.

Leave a comment