In the bustling world of cryptocurrency, where every move can be seismic, there are moments that resonate louder than others. Recently, the spotlight has turned to BlackRock, the financial juggernaut that manages more assets than any other firm worldwide. Why? Because hidden within their recommendations is a game-changing revelation for Bitcoin enthusiasts like me.

BLACKROCK’S BOLD MOVE

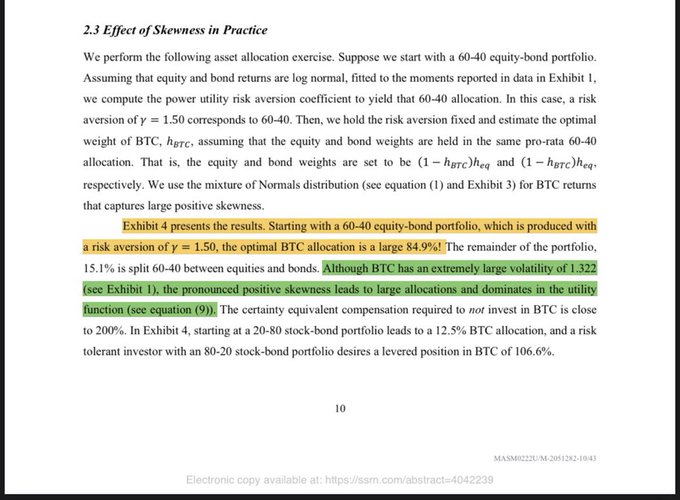

Picture this: BlackRock, the behemoth of asset management, suggesting an optimal allocation of 84.9% in Bitcoin. Yes, you read that right. While this groundbreaking insight was shared in April 2022, it’s only recently caught fire on social media. For someone deeply invested in Bitcoin like myself, this is nothing short of revolutionary.

Source: Twitter

BTC & INSTITUTIONAL APPROVAL

For years, Bitcoin battled skepticism from traditional financial institutions. But now, BlackRock, a titan in the industry, is not just suggesting but urging investors to consider a significant Bitcoin allocation. Their report points out that institutional and retail interest in Bitcoin is soaring, hitting all-time highs. It’s a seismic shift in how the big players view the crypto landscape.

PARALLELS TO GOLD’S GLITTER

BlackRock’s recommendation brings to mind the golden era of gold. In 2004, the introduction of the first gold ETF, championed by BlackRock’s global financial advisors, saw gold prices skyrocket. The parallel is striking. If history repeats itself, the approval of a Bitcoin ETF could have a similar effect on Bitcoin’s value.

THE VALUE PROPOSITION

The report dives into the nuts and bolts of Bitcoin’s performance from 2010 to 2021. For a portfolio of 60% equities and 40% bonds, BlackRock suggests a mind-boggling 84.9% allocation to Bitcoin. The remaining 15.1%? That’s divvied up between equities and bonds. It’s a radical departure from conventional wisdom and underscores BlackRock’s confidence in Bitcoin’s future.

BITCOIN’S POTENTIAL IMPACT

Let’s break down the numbers. If all investors were to heed BlackRock’s call and allocate accordingly, Bitcoin’s value could surpass the combined value of all equities, real estate, and bonds. The total global wealth, estimated at $800 trillion, could catapult Bitcoin to a staggering $190 million per coin. While this number might sound outlandish, it prompts a critical realization – Bitcoin’s potential is vast, and BlackRock is signaling this loud and clear.

A MATURING CRYPTO LANDSCAPE

While the recommendation might seem audacious, it reflects a broader shift in the crypto landscape. Bitcoin, once considered a risky bet, is now being seen as a mature investment. The world is waking up to its potential as a decentralized, inflation-resistant asset. BlackRock’s move is a nod to this changing narrative.

TIMING IS EVERYTHING

Timing, they say, is everything. BlackRock’s report gaining traction aligns with several positive developments in the crypto sphere. Resolutions of key cases, approvals of Bitcoin ETFs, and a global trend toward cryptocurrency adoption have set the stage. It’s a confluence of events signaling a significant turning point.

LOOKING AHEAD: BITCOIN’S NEXT MOVE

With the next Bitcoin halving event on the horizon in 2024, analysts are whispering about an impending bull run. This implies that there’s still time for investors to get in on the action, to accumulate Bitcoin and other digital assets before the next surge. The landscape is evolving, and the perceived risks of crypto investments are diminishing.

JOINING THE BITCOIN REVOLUTION

In my 40s and deeply invested in the crypto space, BlackRock’s recommendation feels like a validation of choices made. It’s not just about the potential windfall if Bitcoin hits astronomical numbers; it’s about being part of a revolution. BlackRock, with its influence, is steering the ship towards Bitcoin. It’s not just an investment; it’s a commitment to the future.

DON’T BE LEFT BEHIND

As someone navigating the complexities of mid-life, I’ve learned that seizing opportunities is key. BlackRock’s bold move is a clarion call for anyone even remotely interested in Bitcoin. The times are changing, and missing out on this wave could mean missing out on a transformative moment in financial history. The train is moving, and it’s time to hop on – before the Bitcoin prices run away beyond reach. 🚂🌌💸

In the dynamic world of cryptocurrencies, BlackRock’s recommendation is a beacon. It’s a call to action for investors, a hint at a potential paradigm shift. As someone who has witnessed the evolution of Bitcoin, this is not just about investments; it’s about being part of something monumental. The question remains – will you join the Bitcoin revolution? 🌐🚀

Leave a comment