My journey in the crypto space has been peppered with both triumphs and pitfalls. One lesson that hit hard was the importance of not leaving my Bitcoin on exchanges. In this personal account, I’ll share my experiences and why, for me, it’s a strict “not your keys, not your coins” policy.

THE WILD WEST OF CRYPTO EXCHANGES

Cryptocurrency exchanges, the bustling marketplaces where we buy, sell, and trade digital assets, have a certain allure. But as I’ve learned through personal experiences and horror stories within the crypto community, they can also be treacherous grounds.

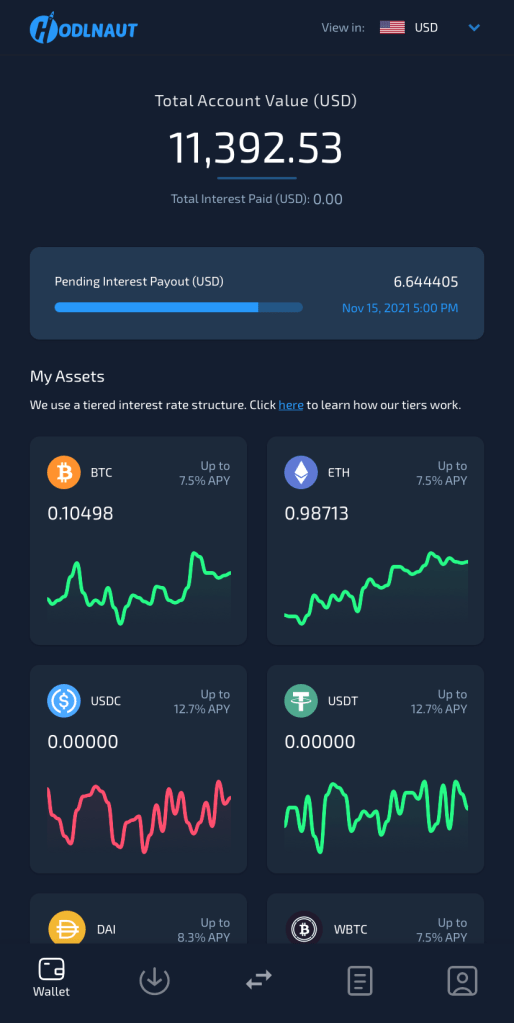

1. THE HODLNAUT DEBACLE

HODLnaut, a once-prominent crypto lending platform, left many investors in the lurch. In my case, the platform ceased withdrawals abruptly, leaving me questioning the safety of my funds.

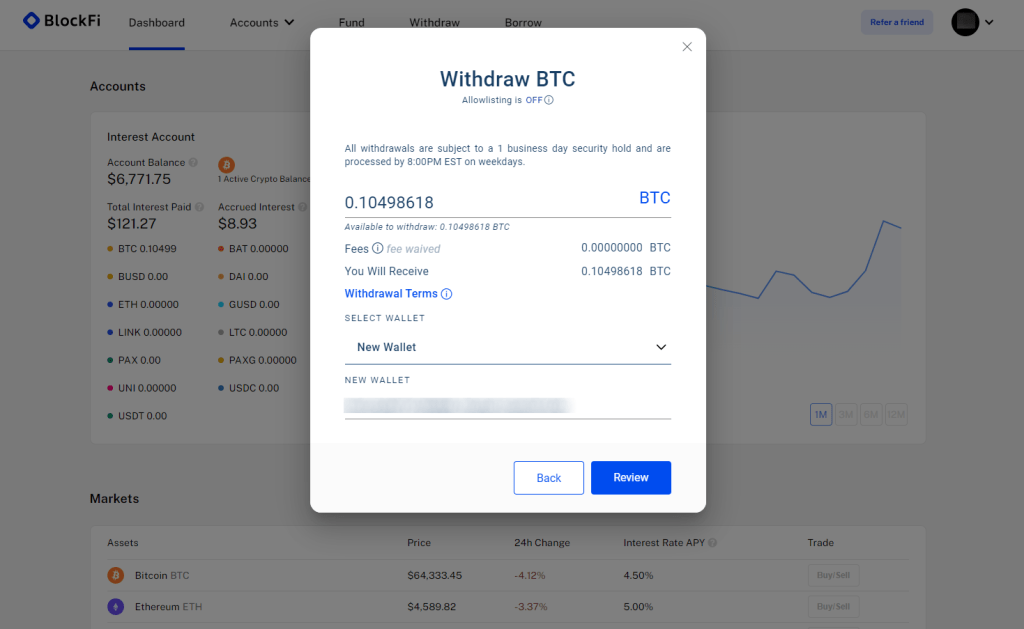

2. THE BLOCKFI SAGA

BlockFi, a platform I once trusted, faced regulatory heat, causing a scare among users. The realization struck – when the regulatory storm hits, it’s the users who might suffer the most.

3. CRYPTOCURRENCY ON CELSIUS NETWORK

Celsius Network, a platform known for its interest-bearing accounts, faced scrutiny and regulatory challenges. The incident served as a stark reminder that the crypto space is still in its infancy, with regulatory uncertainties.

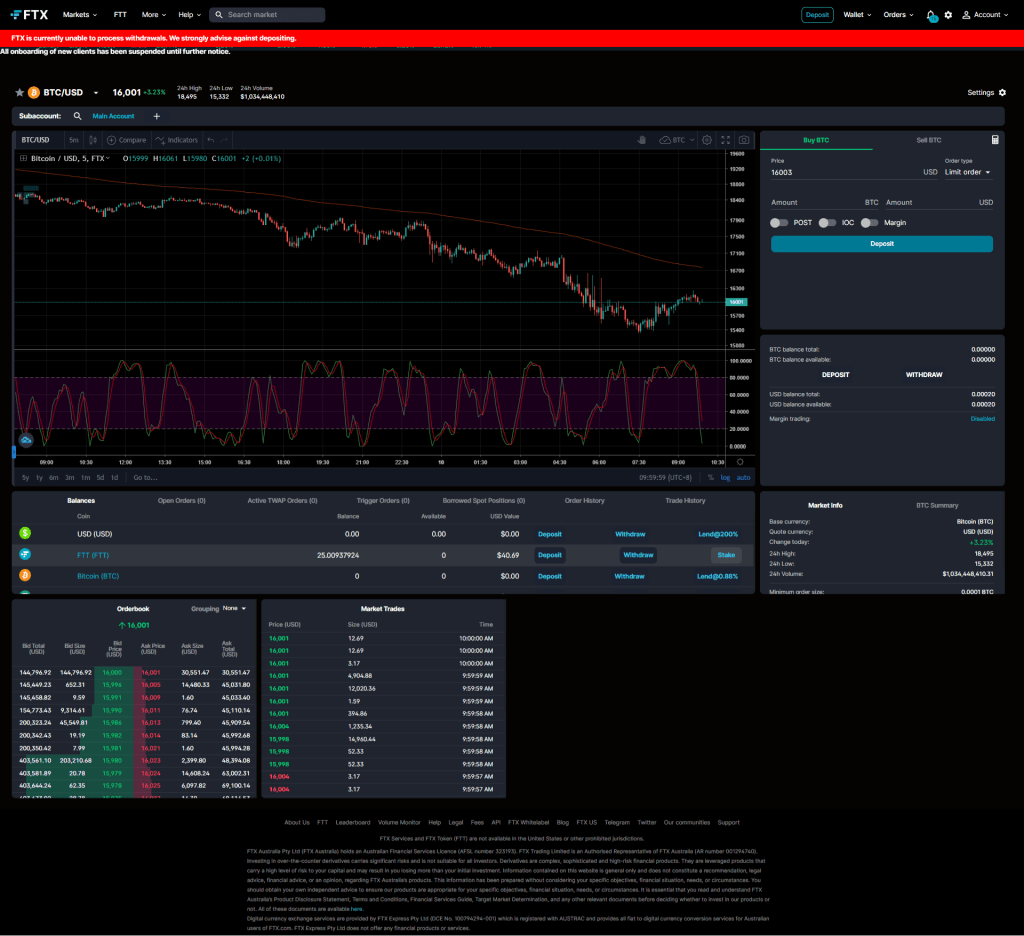

4. FTX AND THE UNEXPECTED HICCUPS

FTX, a platform I believed to be robust, faced technical issues during a market frenzy. The inability to access funds during critical moments underscored the risks of relying on exchange infrastructure.

NOT YOUR KEYS, NOT YOUR COINS: A HARD-LEARNED LESSON

The saying “not your keys, not your coins” became more than a mantra for me – it became a survival guide in the unpredictable terrain of crypto exchanges.

1. REGULATORY UNCERTAINTY

Cryptocurrency regulations vary widely globally. An exchange that operates smoothly today might face regulatory hurdles tomorrow. Owning your keys ensures that regulatory issues on the exchange don’t directly impact your holdings.

2. EXCHANGE VULNERABILITIES

Exchanges, no matter how reputable, are susceptible to hacking, technical glitches, or, in extreme cases, insolvency. When your Bitcoin resides on an exchange, you’re essentially trusting a third party with your wealth.

3. RUNAWAY EXCHANGES

The crypto world has witnessed exchanges suddenly shutting down or, worse, running away with users’ funds. Having your keys in your possession minimizes the risk of waking up to a defunct exchange and vanishing funds.

MY NEW STANDARD OPERATING PROCEDURE

After navigating the rollercoaster of unreliable exchanges, I developed a stringent SOP for handling my Bitcoin investments.

1. GEMINI: MY ONRAMP

Gemini has become my go-to onramp for purchasing Bitcoin. Its regulatory compliance, security measures, and user-friendly interface make it a reliable starting point for my crypto journey. It is still a centralised exchange, do note.

2. COLD WALLET: THE FORTRESS OF MY WEALTH

As soon as the Bitcoin hits my Gemini wallet, it’s swiftly moved to my cold wallet on Trezor. This hardware wallet, detached from the internet when not in use, is my fortress against online threats and exchange vulnerabilities.

3. TIMELY MOVEMENT OF FUNDS

I’ve adopted a proactive approach. The moment I secure Bitcoin, it’s transferred to the cold wallet. This minimizes the time my assets spend on an exchange, reducing exposure to potential risks.

THE LIBERATING POWER OF SELF-CUSTODY

Owning your keys and having control over your private wallet isn’t just a security measure; it’s a declaration of financial independence.

1. SELF-CUSTODY AND FINANCIAL FREEDOM

When your Bitcoin is in your possession, you’re not subject to the terms and conditions of an exchange. You’re free to transact, transfer, or HODL on your terms.

2. EMPOWERING THE INDIVIDUAL

The essence of cryptocurrencies is to empower individuals. By holding your keys, you embody the spirit of decentralization, contributing to the broader narrative of financial autonomy.

LOOKING AHEAD: A SAFER CRYPTO FUTURE

As the crypto space matures, one hopes for improved regulations, more secure exchanges, and enhanced user protections. Until then, the onus is on us as users to navigate this evolving landscape cautiously.

1. USER EDUCATION AND AWARENESS

Educating oneself about the risks and best practices in the crypto space is paramount. Awareness can be the difference between falling victim to a mishap and safely navigating the storm.

2. PRESSURE FOR INDUSTRY STANDARDS

The crypto community should collectively advocate for higher industry standards. Exchanges must prioritize security, transparency, and user protection.

EMPOWERING YOUR CRYPTO JOURNEY

In a space that oscillates between innovation and uncertainty, taking charge of your crypto assets is a liberating experience. My journey from exchange reliance to self-custody has not only been about safeguarding wealth but embracing the ethos of decentralization and financial sovereignty. Remember, in the crypto world, the mantra holds true – not your keys, not your coins!

Leave a comment