The recent turmoil in the cryptocurrency market, triggered by escalating tensions in the Middle East, serves as a stark reminder of the volatility inherent in digital assets. As Bitcoin experiences sharp fluctuations, savvy investors are reminded of the importance of having dry powder money ready to capitalize on these dips. In this article, we delve into strategies for acquiring dry powder, navigating market downturns, and positioning yourself for long-term success in the crypto landscape.

1. Understanding the Bitcoin Bloodbath:

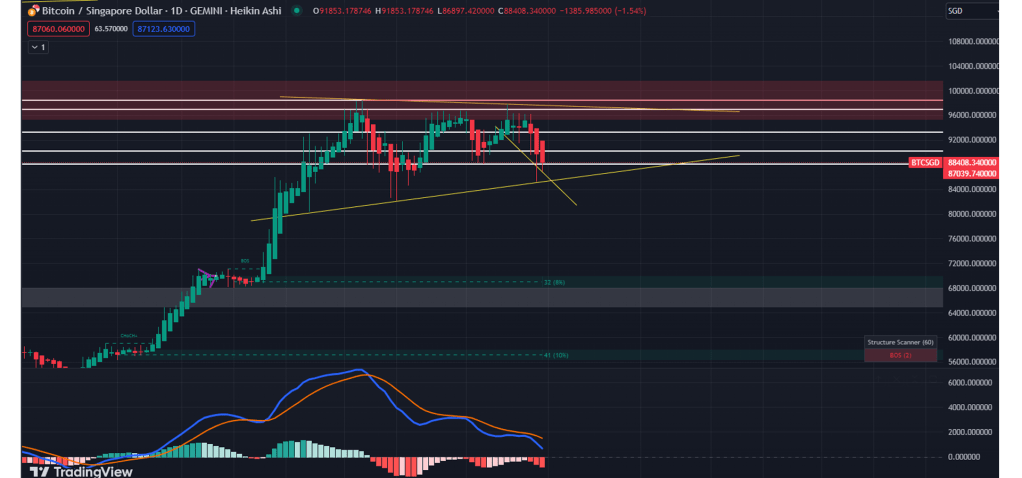

Bitcoin, the flagship cryptocurrency, recently faced a significant downturn following Iran’s retaliatory attacks on Israel. This geopolitical tension sparked risk aversion across global markets, leading to a slump in cryptocurrency prices. Bitcoin, in particular, experienced a notable 7.9% drop, settling at $61,842 on April 13, 2024.

2. The Importance of Dry Powder Money:

Dry powder money refers to funds set aside specifically for investment opportunities that arise during market downturns. Having dry powder gives investors the flexibility to buy assets at discounted prices when others are panicking. This strategy is especially relevant in the volatile world of cryptocurrencies, where price swings can be dramatic.

3. How to Get Dry Powder:

a. Be Frugal: Adopting a frugal lifestyle allows you to save more money for investment purposes. Cut unnecessary expenses, prioritize savings, and allocate a portion of your income to building your dry powder fund.

b. Engage in Side Hustles: Supplement your primary income by exploring side hustles or freelance opportunities. Use the additional income to bolster your dry powder reserves without compromising your regular financial obligations.

4. Seizing the Dip:

When market downturns occur, it’s essential to stay level-headed and avoid succumbing to panic selling. Instead, view these dips as buying opportunities. With dry powder at your disposal, you can take advantage of discounted prices and accumulate cryptocurrencies like Bitcoin when their value is depressed.

5. Reaping Rewards in the Future:

By tightening your pocket now and strategically deploying dry powder to buy Bitcoin during dips, you position yourself for significant rewards in the future. As Bitcoin’s price is projected to reach $1 million by 2030, according to some estimates, investing during downturns can lead to substantial gains when the market rebounds.

6. Embracing Financial Freedom:

Accumulating wealth through strategic investments, including cryptocurrencies like Bitcoin, provides financial freedom and flexibility. Achieving a level of “fuck you money,” where you have the resources to pursue your passions and dreams without financial constraints, becomes attainable through prudent investment strategies and disciplined saving habits.

Conclusion:

The recent Bitcoin bloodbath amid geopolitical tensions underscores the need for preparedness and strategic investment approaches. By prioritizing dry powder accumulation, being frugal, engaging in side hustles, and seizing opportunities during market downturns, investors can navigate volatility effectively and pave the way for long-term financial success and freedom

Leave a comment