The story of Bitcoin’s journey from its humble beginnings to its current status as a digital asset of significant value is a fascinating one. For many, Bitcoin represents not just a financial investment but also a symbol of technological innovation and the changing landscape of global currencies. One intriguing angle to explore is how the value of Bitcoin has evolved in terms of its purchasing power for real estate, specifically in Singapore, over the years.

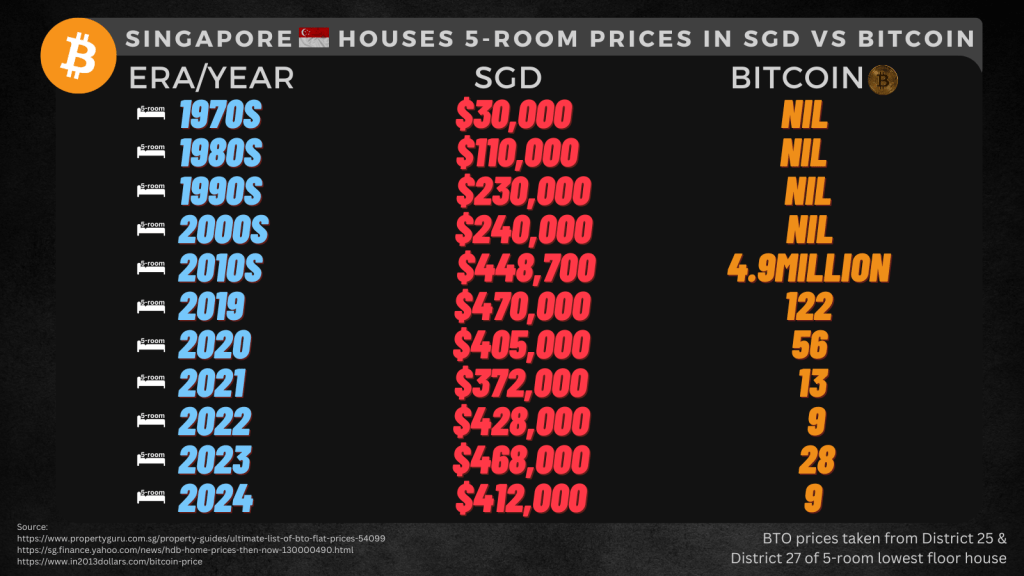

Let’s take a step back to 2010, when Bitcoin was trading at a mere 0.09 cents. Back then, a house in Singapore would set you back around $448,700. To purchase this house with Bitcoin at that time, you would have needed a staggering 4.9 million Bitcoins.

Fast forward to today, where a 5-room BTO house costs approximately SGD$412,000 or around 9 Bitcoins, given a Bitcoin price of USD$44,000, based on January 1st of each year. This shift is nothing short of astonishing.

As we can see from the data, while the cost of houses in Singapore has generally increased over the years, the amount of Bitcoin required to purchase these houses has decreased significantly. This phenomenon is a testament to both the appreciation of Bitcoin’s value and the escalating prices in the real estate market.

What’s even more intriguing is the question of when 1 Bitcoin might be enough to buy an entire house in Singapore. Extrapolating from the figures above, we can speculate that this milestone could potentially be reached within the next decade, assuming the current trends continue. Of course, this is just a playful extrapolation and should be taken with a grain of salt, considering the inherent volatility of cryptocurrency markets and real estate prices.

I used ChatGPT to extrapolate Bitcoin purchasing power over the years. I personally feel $70,000 Bicoin in 2025 is bearish but I agree BTC can reach millions in the coming decade. Let’s hope houses prices doesn’t inflate that much.

| Year | Bitcoin Price (USD) | Estimated House Cost (SGD) | Estimated Bitcoin Required |

|---|---|---|---|

| 2010 | $0.09 | $448,700 | 4.9 million |

| 2015 | $70 | $500,000 | 7143 |

| 2020 | $5,000 | $405,000 | 81 |

| 2025 | $70,000 | $420,000 | 6 |

| 2030 | $1,000,000 | $520,000 | 0.5 |

In conclusion, the story of Bitcoin’s purchasing power for real estate in Singapore is a captivating narrative of digital currency intersecting with traditional assets. It serves as a reminder of the dynamic nature of financial markets and the ever-evolving relationship between technology and wealth.

Leave a comment