In the midst of the 2020 COVID-19 lockdown, my journey with Bitcoin ignited like a phoenix rising from the ashes of financial uncertainty. Locked in our homes with time on our hands, I refused to let my hard-earned savings languish in banks offering mere peanuts in interest. Thus, I delved into the world of investments, initially venturing into stocks through Interactive Brokers.

Unleashing the Crypto Beast: Temptations and Triumphs

Disappointed by the paltry returns from stocks, I ventured into the wild realm of cryptocurrencies. Bitcoin and Ethereum beckoned, with Bitcoin priced at a mere USD 8.5K and Ethereum at USD 200 during the infamous Black Swan crash. While hesitant about Bitcoin’s apparent “lateness,” I plunged into Ethereum. Yet, the siren calls of influencers peddling “next Bitcoin” wonders like Cardano and Defichain proved both alluring and perilous.

Navigating Crypto’s Stormy Seas: Lessons in Blood and Grit

My crypto odyssey was fraught with trials and tribulations. Central exchanges froze accounts as markets crashed, shitcoins hemorrhaged value, and dubious figures like Sam Bankman-Shithead lurked in the shadows. Through grit and research, I uncovered Bitcoin’s intrinsic value—its scarcity, peer-to-peer settlement, and emancipation from financial intermediaries.

Embracing the Bitcoin Revolution: Defying Fiat’s Chains

My faith in Bitcoin’s revolutionary potential transcended mere investment. Satoshi Nakamoto’s vision of a decentralized, deflationary currency became my beacon in a sea of fiat mediocrity. Bitcoin wasn’t just an asset; it was a paradigm shift, a rebellion against the fiat tyranny strangling global economies.

From Fiat Folly to Bitcoin Brilliance: A Personal Metamorphosis

I shed the shackles of fiat currency, transforming spare change into Satoshis, Bitcoin’s lifeblood. This wasn’t just financial strategy—it was a crusade for financial liberation. Bitcoin’s meteoric rise, a fivefold appreciation, validated my belief in its transformative power.

Bitcoin: The Flame of Financial Liberation

Bitcoin’s allure lies not just in profits but in its promise of financial emancipation. Unlike stocks or bonds, Bitcoin isn’t beholden to governments’ whims or central banks’ money-printing frenzy. It’s a lifeline to escape the rat race, a roadmap to true financial autonomy.

Challenges Ignite Advocacy: Fueling the Bitcoin Revolution

My fervor for Bitcoin isn’t madness; it’s a response to systemic fiat failures. Governments and banks inflate currencies, eroding citizens’ wealth. Bitcoin stands as a beacon of stability, immune to inflationary folly.

Bitcoin’s Fire, Fiat’s Funeral: A Revolutionary Destiny

In essence, my Bitcoin journey isn’t just personal; it’s a call to arms for a financial revolution. Bitcoin isn’t just digital gold; it’s the fiery phoenix that heralds a new era of financial sovereignty, where individuals, not institutions, dictate their economic destiny.

| Bitcoin | Fiat Money (Traditional Currency) |

|---|---|

| Limited Supply | Unlimited printing, leading to inflation and devaluation. |

| Decentralized | Centralized control by governments and central banks. |

| Immutable Ledger | Vulnerable to fraud, manipulation, and censorship. |

| Global Accessibility | Restricted access in unbanked regions and underprivileged populations. |

| Lower Transaction Fees | Higher fees due to intermediaries and banking infrastructure. |

| Fast Transactions | Slow processing times, especially in cross-border transfers. |

| Financial Sovereignty | Dependence on banks and financial institutions for access. |

| Inflation Hedge | Susceptible to inflation, eroding purchasing power over time. |

| Transparent & Trustworthy | Lack of transparency and trust in monetary policies. |

| Technological Innovation | Lagging behind in adopting blockchain and digital finance. |

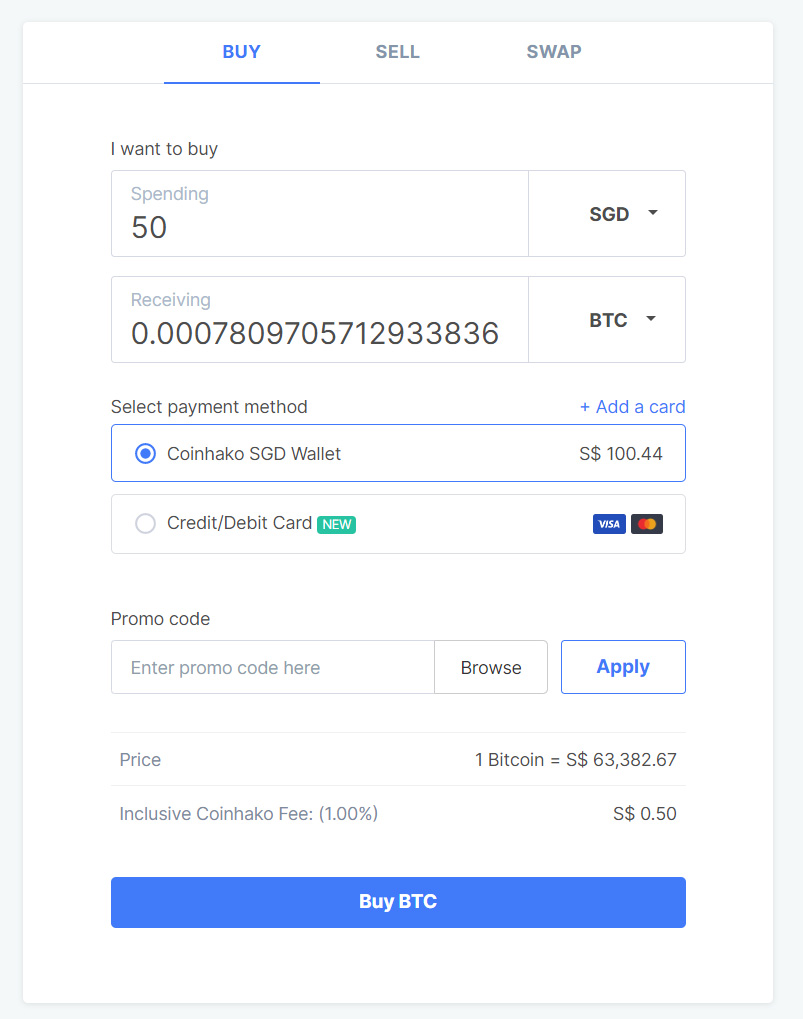

Act now, get off zero in terms of Bitcoin. You’ll thank me down the road for attaining fuck you money and generational wealth. (Not financial advice)

Leave a comment