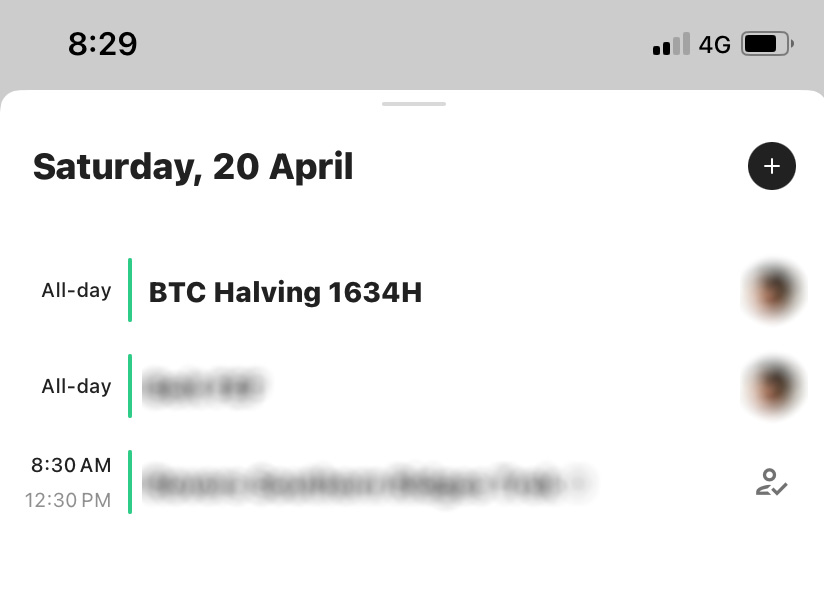

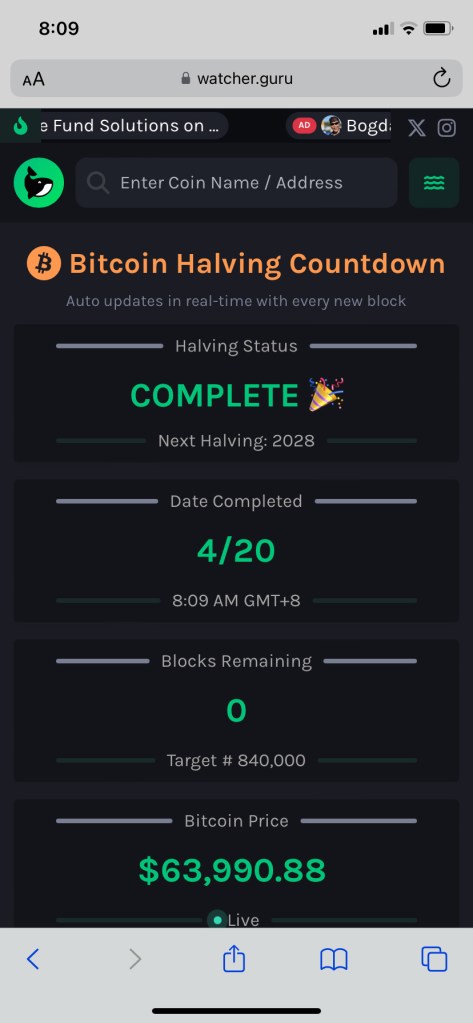

The recent Bitcoin Halving on April 20th, 2024, brought about a mix of expected and unexpected developments. As I woke up that day, the world seemed normal, with some of my Buy Limit orders getting filled amidst Bitcoin’s usual fluctuations.

Surging Transaction Fees: A Tale of Wealth and Folly

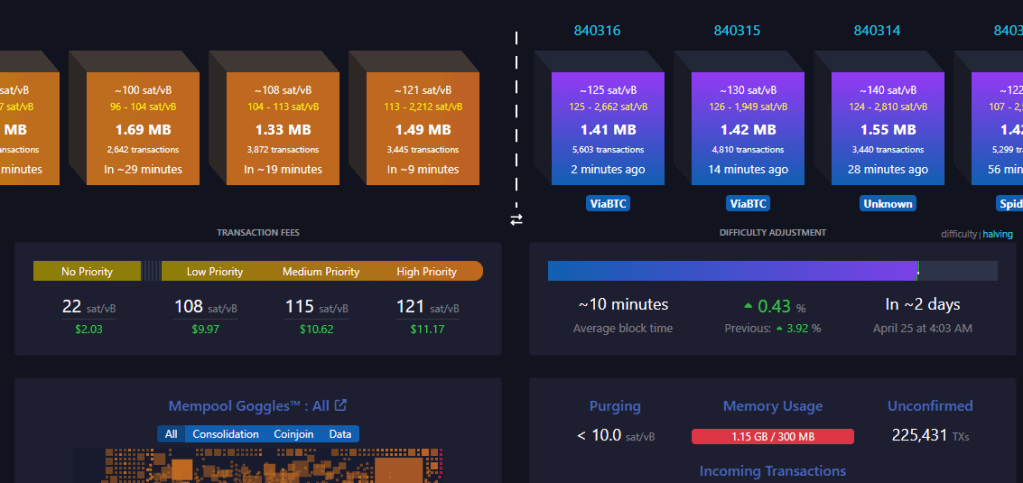

However, what caught my attention was the skyrocketing miner transaction fees, not due to Bitcoin issues but rather because of individuals vying to be part of the 840,000 Halving Block for the sake of ‘history.’ It felt like a race to incentivize miners for transaction prioritization, especially with transaction fees reaching half a million dollars. It made me question the priorities, especially when there are so many in need globally.

Lessons Learned: Timing and Transfers

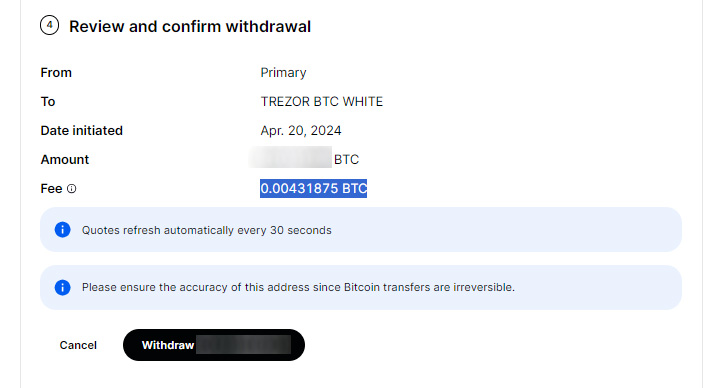

One crucial lesson from this Halving was not to wait when it comes to moving Bitcoin. I had been holding off transferring my Bitcoin from Gemini to my Trezor hardware wallet, waiting for lower on-chain transaction fees below USD 10. However, on Halving day, fees surged to an astonishing USD 275! This taught me not to time the market but to act promptly in transferring my assets to avoid such spikes in fees.

Life Goes On: DCA Strategy and Decentralization

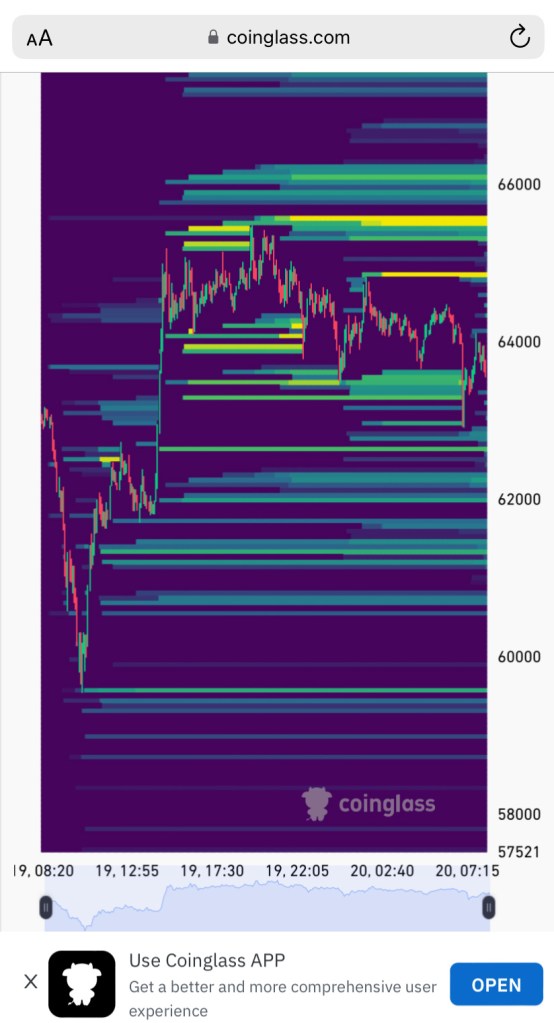

Despite the drama of the Halving, life in the Bitcoin world continued for me. I stuck to my Dollar-Cost Averaging (DCA) strategy, buying Bitcoin under USD 65,000, which I considered a steal. The beauty of Bitcoin, unlike centralized entities like the Fed and banks, is its decentralized nature, empowering individuals to control their assets without external interference.

The Technical Side: Understanding the Halving

From a technical standpoint, the Halving is a programmed event designed to reduce the rate of new Bitcoin issuance. This time, the mining reward was halved, affecting miners’ revenue but aligning with Bitcoin’s deflationary design and eventual 21 million cap.

Market Impact: Mixed Reactions and Long-term Outlook

While some expected the Halving to catalyze a bull market, others, including analysts from JPMorgan and Deutsche Bank, viewed it as already factored into the market. The immediate aftermath saw a spike in transaction fees but also witnessed subsequent drops, showcasing the dynamic nature of Bitcoin’s ecosystem.

Future Prospects: Challenges and Opportunities

Looking ahead, the impact of Halving extends beyond immediate price shifts to the mining sector’s dynamics. Publicly-listed miners are poised to adapt and innovate, leveraging funding and technology to navigate evolving landscapes.

Conclusion: A Continual Journey

In essence, the Bitcoin Halving is not just a singular event but part of an ongoing journey in the cryptocurrency world. It teaches us about resilience, adaptation, and the ever-evolving nature of digital assets in a global economy.

Leave a comment