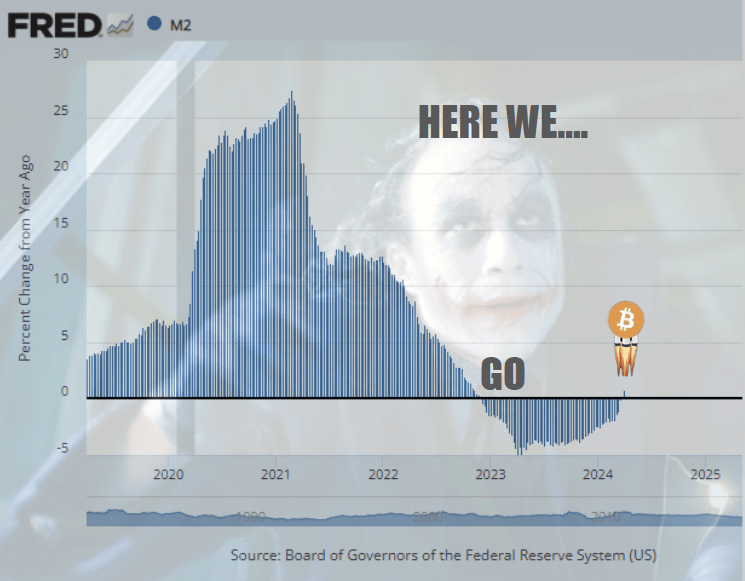

Money printer goes brrrrrrrrrrrr

As the global economy navigates through various financial indicators, the recent positive turn in the M2 money supply presents an intriguing landscape for Bitcoin enthusiasts. This shift not only reflects economic dynamics but also opens up new possibilities for Bitcoin as a resilient asset in an evolving financial ecosystem.

Market Sentiment Boost

The uptick in the M2 money supply brings a wave of optimism, signaling confidence in economic recovery and growth prospects. This positive sentiment can spill over into the cryptocurrency market, particularly benefiting Bitcoin. Investors, fueled by optimism, often seek alternative assets like Bitcoin for potential high returns and diversification.

Inflation Hedge and Value Retention

One of Bitcoin’s inherent strengths lies in its deflationary nature and limited supply. As the money supply expands, concerns about inflation may arise, driving investors towards assets that can preserve value. Bitcoin, with its fixed supply and decentralized framework, emerges as a preferred choice for those seeking a hedge against potential inflationary pressures.

Reshaping Investor Portfolios

The positive trajectory of the M2 money supply prompts investors to reassess their portfolios. Bitcoin, known for its non-correlation with traditional markets, becomes an attractive addition for portfolio diversification. The asset’s historical resilience and growth potential make it a compelling option for investors looking beyond traditional investment avenues.

Regulatory and Institutional Attention

With the spotlight on economic indicators like the M2 money supply, regulatory bodies and institutions are closely monitoring market trends. This increased scrutiny often translates into a deeper examination of cryptocurrencies, including Bitcoin. Regulatory clarity and institutional involvement can further bolster investor confidence and mainstream adoption of Bitcoin.

The Path Ahead for Bitcoin

In light of the positive turn in the M2 money supply, Bitcoin stands at a pivotal juncture. Its narrative as a store of value, inflation hedge, and digital gold gains prominence. The evolving financial landscape, coupled with macroeconomic factors, sets the stage for Bitcoin to shine as a resilient and promising asset class.

Conclusion

In conclusion, the positive M2 money supply growth offers a favorable backdrop for Bitcoin’s journey. As investors navigate through economic shifts, Bitcoin’s unique value propositions come to the forefront. From market sentiment boosts to inflation hedging strategies, Bitcoin continues to carve its niche as a transformative force in the global financial arena.

Leave a comment