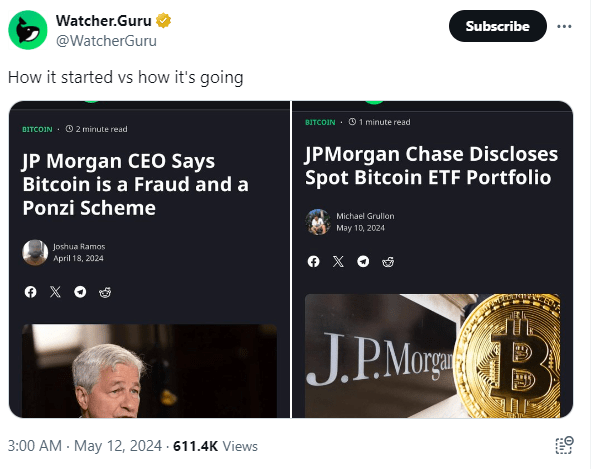

In the world of finance, banks have often been criticized for their double standards and contradictory statements. Just last April, JPMorgan Chase & Co’s Jamie Dimon famously labeled Bitcoin as a fraud and a ponzi scheme. However, recent revelations have shed light on the hypocrisy within the banking sector.

TLDR

- Banks criticized for double standards; Dimon called Bitcoin fraud.

- Banks invest in Bitcoin ETFs despite public criticisms.

- JPMorgan and Wells Fargo Bank disclose significant Bitcoin holdings.

- Banks’ shift towards Bitcoin reflects changing views.

- Bitcoin offers hedge against traditional banking uncertainties.

- Embrace Bitcoin amid banking contradictions for investment opportunities.

The Revelation of Bank Investments in Bitcoin ETFs

Despite their public criticisms, major banking institutions like JPMorgan and Wells Fargo have quietly been investing in Bitcoin through spot Bitcoin ETFs. This unexpected turn of events showcases the shifting dynamics and interests within traditional finance.

JPMorgan’s Bitcoin Holdings Unveiled

JPMorgan, the largest banking institution globally, has disclosed substantial holdings in various Bitcoin ETFs (Source: Form F13 Filing). Their diversified approach to cryptocurrency investments includes significant stakes in ETFs like Bitcoin Depot Inc., demonstrating a strategic move towards embracing the crypto market.

Wells Fargo’s Stealthy Bitcoin ETF Investment

Not to be outdone, Wells Fargo has also revealed its exposure to Bitcoin ETFs, particularly holding shares in the Grayscale Bitcoin ETF (GBTC). This newfound interest in Bitcoin investments by major banks signals a significant departure from their previous skepticism.

The Changing Tide: Banks’ Shifting Views on Bitcoin

The sudden influx of banks into the Bitcoin investment space marks a notable shift in their stance. Despite past denouncements, banking giants are now actively participating in the crypto market, reflecting a growing acceptance and recognition of Bitcoin’s potential as an investment vehicle.

Bitcoin’s Value Proposition: A Hedge Against Traditional Banking

For those who distrust banks and their fluctuating opinions, Bitcoin emerges as a reliable alternative. While fiat currencies remain essential for everyday transactions, storing wealth in Bitcoin (Sats) offers a hedge against traditional banking uncertainties and manipulations.

Conclusion: Embracing Bitcoin Amidst Banking Contradictions

As banks navigate their evolving relationship with Bitcoin, investors are presented with new opportunities and challenges. The contrast between banks’ public criticisms and private investments in Bitcoin ETFs underscores the complex dynamics of the financial world. Embracing Bitcoin’s potential while remaining vigilant about banking practices becomes paramount in today’s ever-changing financial landscape.

Leave a comment