The recent developments in the Bitcoin market have sparked a new wave of optimism among investors. As the Grayscale Bitcoin Spot ETF (GBTC) shows signs of stabilizing, experts predict that Bitcoin’s value could soar to $100,000, triggering a frenzy of excitement and fear of missing out (FOMO) among potential investors.

TLDR

- Recent Bitcoin market developments spark optimism; experts predict $100,000 value, causing excitement and FOMO.

- GBTC stabilization hints at price increase, positive market sentiment.

- Challenges like high GBTC fees; partnerships offer growth.

- FOMO at $100,000 drives demand, caution needed for volatility.

- Anticipated sell-off at $100,000; understanding market crucial.

- Strategies for managing $100,000 Bitcoin: diversification, risk management.

- Acknowledging psychological impact; staying informed key.

The Rise of GBTC and Its Impact on Bitcoin’s Price

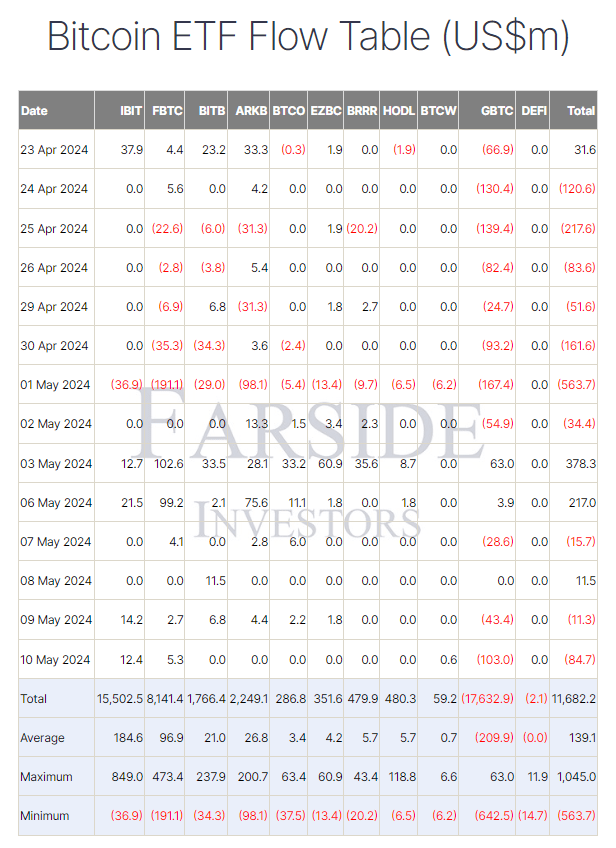

The tapering off of outflows from the Grayscale Bitcoin ETF (GBTC) is a positive indicator for the market. This trend suggests that investors are becoming less bearish on Bitcoin or are adopting a wait-and-see approach before making further withdrawals from GBTC. While this doesn’t guarantee immediate inflows into GBTC, it hints at a shifting sentiment towards Bitcoin, which could drive its price upwards.

The GBTC Factor: A Game-Changer for Bitcoin

GBTC’s decreasing outflows signal a potential shift in market dynamics. With other Bitcoin ETFs also experiencing fluctuating flows, the focus is on whether GBTC will attract net inflows in the future, a development that could bolster Bitcoin’s bullish trajectory. Analysts predict that Grayscale could exhaust its Bitcoin holdings by July 08, 2024, but factors like slowing outflows and competitive alternatives could delay this eventuality.

Challenges and Opportunities in the Bitcoin ETF Landscape

While GBTC faces challenges such as high fees and competition from platforms like Mini Bitcoin ETF, its strategic partnerships with FTX and Genesis offer growth opportunities. Analysts believe that if GBTC attracts inflows, even a modest fee of 1.5% could generate substantial revenue. However, investor interest in Bitcoin remains subdued, with Bitcoin ETFs witnessing consecutive outflows, highlighting the need for sustained market confidence.

Navigating Market Uncertainties: A Path to $100,000 Bitcoin

Despite recent price dips and limited buying interest, Bitcoin’s resilience lies in its ability to weather market fluctuations. Monitoring social interest levels and sentiments like fear, uncertainty, and doubt (FUD) can provide insights into Bitcoin’s future trajectory. As Bitcoin inches closer to the crucial support level of $60,000, understanding market dynamics becomes imperative for investors eyeing the coveted $100,000 milestone.

The Psychological Impact of Bitcoin at $100,000

The $100,000 mark holds significant psychological weight for retail users. Many investors experience FOMO when Bitcoin reaches this milestone, fearing that they’ve missed out on potential gains. This sentiment drives a surge in demand as individuals rush to buy Bitcoin at $100,000, believing that its price will continue to surge higher.

Navigating the FOMO Phenomenon

FOMO-driven buying at $100,000 can create a temporary surge in Bitcoin’s price, fueled by retail investors’ desire to participate in its upward momentum. However, this surge may also be accompanied by increased volatility as speculative trading intensifies. It’s important for investors to approach such market movements with caution and a long-term perspective.

Anticipating a Sell-Off at $100,000

Contrary to FOMO-driven buying, some investors may view Bitcoin’s rise to $100,000 as an opportunity to sell and take profits. This anticipated sell-off can create short-term price fluctuations as traders seek to capitalize on Bitcoin’s price movements. Understanding market dynamics and investor behavior becomes crucial in navigating such periods of heightened activity.

Strategies for Managing $100,000 Bitcoin

For retail investors experiencing FOMO, it’s essential to approach $100,000 Bitcoin with a balanced perspective. Diversification, risk management, and a long-term investment strategy can help mitigate the effects of short-term market fluctuations. Additionally, staying informed about market trends and maintaining realistic expectations are key to making informed investment decisions.

Conclusion: Embracing the Future of Bitcoin

As the landscape of Bitcoin evolves, navigating through market uncertainties becomes crucial for investors and enthusiasts alike. The potential for Bitcoin to reach $100,000 hinges on factors like GBTC’s performance, investor sentiment, and market trends. By staying informed and proactive, individuals can position themselves to capitalize on Bitcoin’s promising journey towards mainstream acceptance and value appreciation.

As Bitcoin’s value approaches $100,000, it’s important to acknowledge the psychological impact it has on retail investors. While FOMO-driven buying and anticipated sell-offs may lead to short-term volatility, a measured approach to investing can help navigate these fluctuations. By understanding the dynamics of market sentiment and employing sound investment strategies, individuals can position themselves to embrace the potential of Bitcoin’s journey beyond $100,000.

Keep stacking Sats!

Leave a comment