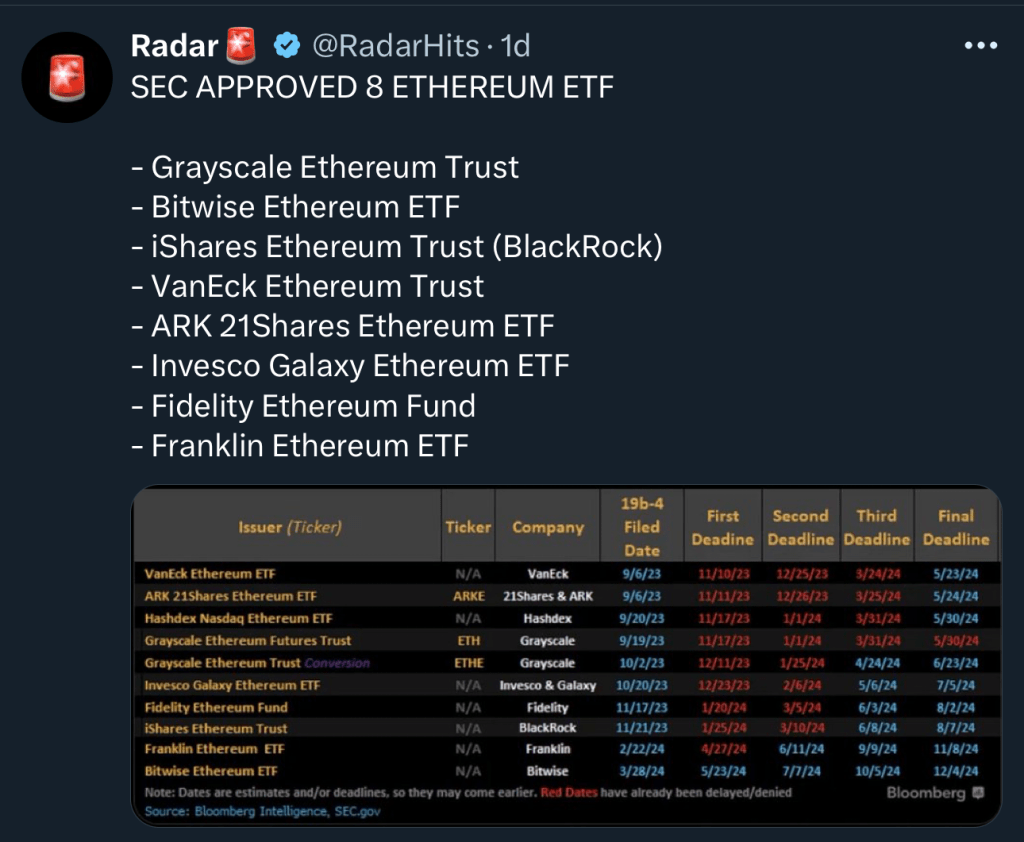

A few days ago, the SEC surprised everyone by approving the Ethereum ETF. If you support and hold Ethereum, good for you. I wish you all the best. It doesn’t affect me, and I’m cool with it. Ethereum and other altcoins can have their time in the spotlight with their own ETFs for all I care.

What is an ETF?

An ETF, or Exchange-Traded Fund, is a type of investment fund that is traded on stock exchanges, much like stocks. ETFs hold assets such as stocks, commodities, or in this case, cryptocurrencies like Ethereum. They allow investors to buy shares that represent a fraction of the asset’s value, making it easier to invest in a diversified portfolio without owning the assets directly.

The approval of an Ethereum ETF means that investors can now buy shares of Ethereum without having to deal with the complexities of buying, storing, and securing the cryptocurrency themselves. This is a significant step towards mainstream adoption and could potentially drive up demand and price for Ethereum.

My Belief in Bitcoin

In the end, I truly believe every altcoin and everything else will trend to zero compared to Bitcoin. Bitcoin is like a black hole that sucks everything in. Its unique properties—such as its fixed supply cap of 21 million coins, decentralized nature, and first-mover advantage—make it the most secure and valuable cryptocurrency in the market.

Why I’m Unfazed by the Ethereum ETF

The Ethereum ETF approval doesn’t change my stance on Bitcoin. Bitcoin’s dominance in the crypto market remains unparalleled. While other cryptocurrencies, including Ethereum, may offer interesting use cases and short-term gains, I believe Bitcoin’s long-term value proposition is unmatched.

The Future of ETFs

ETFs are a double-edged sword. On one hand, they provide easy access to the asset for institutional and retail investors, potentially increasing adoption and driving up prices. On the other hand, they also introduce new layers of complexity and regulatory oversight, which can stifle the decentralized ethos of cryptocurrencies.

Making Informed Decisions

It’s your money, and you can do whatever you want with it. Just don’t look back with regret about the choices you made. Stick with your decisions and accept the wins and losses that come with them. The world of crypto is volatile and unpredictable, and making informed decisions is crucial.

A Decade from Now

Let’s meet again in a decade and see which ETF won. For now, stay informed and make choices that align with your beliefs and goals. In the world of crypto, it’s all about long-term vision and conviction.

Whether it’s Bitcoin, Ethereum, or any other cryptocurrency, the market will always have its ups and downs. Stay strong, stay informed, and let’s see where this journey takes us. Investing in cryptocurrencies is a personal journey, and it’s important to stay true to your own convictions while keeping an open mind to new developments and opportunities.

By understanding the technical aspects of ETFs and the unique value propositions of different cryptocurrencies, you can make more informed decisions about your investments. Whether you’re bullish on Bitcoin like me, or excited about the potential of Ethereum and other altcoins, the key is to stay informed, stay patient, and stay true to your investment strategy.

Leave a comment