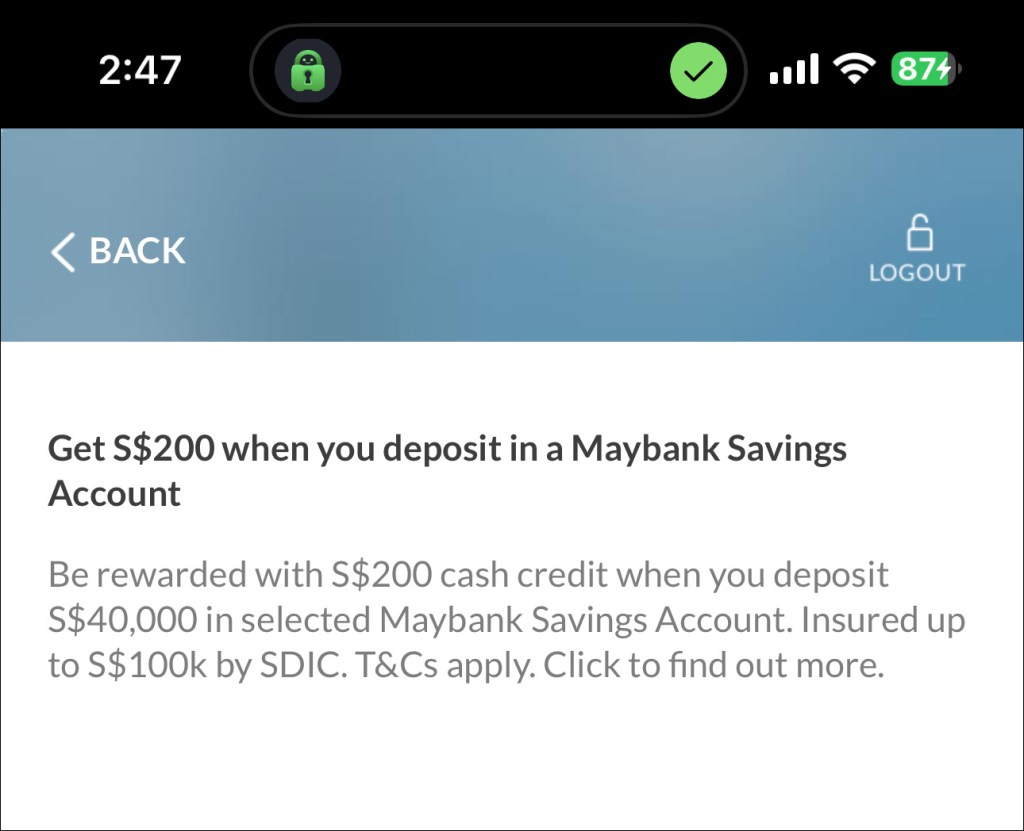

I recently came across a bank promotion, and it got me thinking about the choices we make and the risks we’re willing to take with our money. The offer was simple: deposit $40,000 and earn a 0.5% return. While that’s a guaranteed $200, it’s quite a modest gain.

The Bank’s Offer: Is It Worth It?

Let’s break down the bank’s offer. A 0.5% return on $40,000 means you’ll earn $200 one time offer, and probably even lower returns annually. This kind of return is typical for low-risk, conservative savings accounts or fixed deposits. It’s safe, secure, and guaranteed by the bank. But in today’s economic climate, with inflation rates often surpassing the interest earned, is this really the best option for growing your wealth?

Exploring Alternatives: Bitcoin Investment

On the other hand, there’s Bitcoin. My experience with Bitcoin has been far more rewarding. I’ve managed to triple my holdings by sticking to a strategy of HODLing—holding on for dear life. Bitcoin, while volatile, has the potential for returns that dwarf the bank’s offer. Over the past decade, Bitcoin has provided returns ranging from 200% to 1,000% in certain years.

The Bitcoin Standard: My Personal Journey

I’ve chosen a Bitcoin Standard life. Every asset I have that isn’t tied to fiat currency is converted into Satoshis (Sats). This decision isn’t just about chasing high returns; it’s about believing in what Bitcoin represents. Bitcoin isn’t just a digital currency; it’s a movement. It aims to fix the financial troubles of the world, providing an avenue to financial freedom for me and my future children.

The Philosophy Behind Bitcoin

Bitcoin operates on a decentralized network, free from the control of central banks and governments. This decentralization means no single entity can manipulate its value or supply. Unlike fiat money, which can be printed at will by those in power, Bitcoin has a fixed supply of 21 million coins. This scarcity is built into its code, ensuring its value cannot be diluted through inflation.

The Risk Factor: Understanding Volatility

Of course, investing in Bitcoin isn’t without risks. Its price can be highly volatile, with significant swings in value over short periods. However, for those who believe in its long-term potential, these fluctuations are just part of the journey. The key is to stay informed, understand the market dynamics, and remain patient.

Conclusion: Bank or Bitcoin?

So, what’s the better choice? For me, it’s clear. While the bank offers a safe and modest return, Bitcoin offers the potential for significant gains and the promise of financial freedom. It’s about taking control of my financial destiny and opting out of a system that seems increasingly unsustainable.

In the end, it’s about more than just the money. It’s about making a statement, giving a big F U to those who are close to the money printer and benefiting from an unfair system. By front-running them, I’m not just securing my financial future; I’m also supporting a revolutionary technology that could change the world.

Leave a comment