I chuckled when I came across an article claiming, “Bonds are beating Bitcoin as doubts gather over crypto rebound.” It’s amusing because while this might hold some truth in the short term, for those of us with a long-term perspective, it’s just noise. If you’re not a trader and are instead looking to retire in 20-30 years, this kind of sensationalism is more confusing than informative.

Short-Term Volatility vs. Long-Term Gains

Sure, bonds might be outperforming Bitcoin in the short term. But let’s remember the fundamental difference between these investment vehicles. Bonds are traditionally seen as safer, more stable investments with lower returns. Bitcoin, on the other hand, is known for its volatility and potential for high returns over the long haul. For long-term HODL’ers, the day-to-day fluctuations are less concerning. It’s the overall trajectory that matters.

The Long-Term View

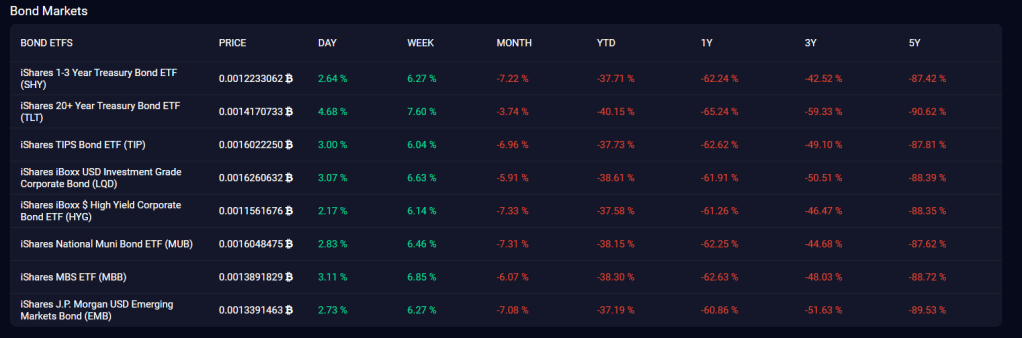

Take a look at the long-term performance of bonds. Historically, bonds have provided modest returns, typically ranging from 3% to 5% annually. While they are less risky, they don’t offer the same potential for significant growth as equities or cryptocurrencies.

Now, consider Bitcoin’s performance since its inception. Despite periods of extreme volatility, Bitcoin has shown a remarkable upward trend over the years. Those who invested early and held on have seen substantial returns. The key takeaway here is patience and the ability to weather short-term storms for potential long-term gains.

Misleading Articles and Clickbait

Articles like the one mentioned are often written with a motive: to generate clicks. The author of that piece likely knows that headlines comparing bonds to Bitcoin will grab attention. But these comparisons can be misleading, especially for inexperienced investors who might be swayed into making poor financial decisions based on short-term trends.

Do Your Own Research

Always question what you read, even my posts. It’s essential to do your own research and not blindly follow the media, which often has its own agenda. Look at a wide range of sources, analyze the data, and consider your own financial goals and risk tolerance.

Remember, investing is not one-size-fits-all. What works for one person might not work for another. Diversify your investments to spread risk and potentially increase returns.

Technical Insights for Informed Decisions

For those interested in the technical side, it’s worth noting that bonds and Bitcoin operate in fundamentally different markets. Bonds are debt securities issued by governments or corporations, providing fixed interest payments over time. They’re considered lower risk, but inflation can erode their real returns.

Bitcoin, a decentralized digital currency, operates on blockchain technology, offering a potential hedge against inflation. Its finite supply and growing adoption can drive value appreciation over time. However, its volatility is driven by market sentiment, regulatory news, and technological developments.

Conclusion

In summary, don’t let sensational headlines divert you from your long-term investment strategy. Bonds and Bitcoin serve different purposes in a diversified portfolio. Stay informed, question the motives behind articles, and make decisions based on thorough research and your own financial goals. Remember, in the world of investing, patience and knowledge are your best allies. Do not trust but verify.

Leave a comment